Transforming CVRM Health: The future of metabolic medicine discussed by leading experts at NLSDays

One of the hot topics discussed during NLSDays 2025 in Gothenburg was the latest research, innovative treatments, and emerging technologies shaping the future of CVRM and metabolic health.

Cardiovascular, Renal, and Metabolic (CVRM) health is a rapidly evolving field, representing a convergence of disciplines that are critical to patient well-being and longevity.

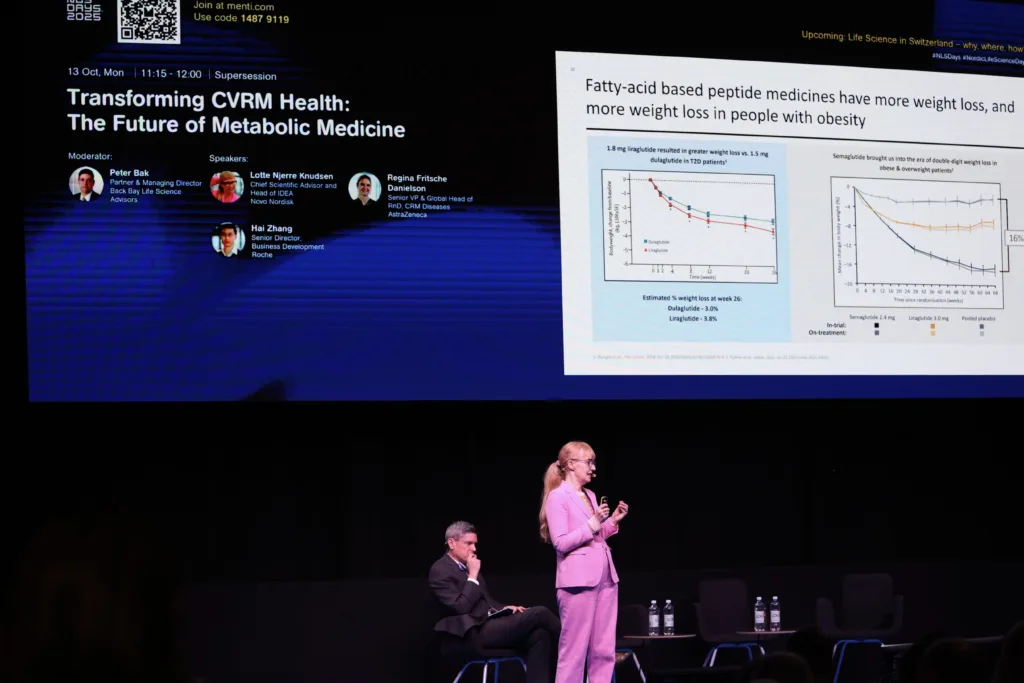

One of the supersessions at NLSDays 2025 was dedicated to the topic. The panel, moderated by Peter Bak, Partner & Managing Director at Back Bay Life Science Advisors, featured Hai Zhang, Senior Director, Business Development at Roche, Regina Fritsche Danielson, Senior VP & Global Head of RnD, CVRM Diseases at AstraZeneca, and Lotte Bjerre Knudsen, Chief Scientific Advisor and Head of IDEA at Novo Nordisk.

Peter Bak kicked off the discussion about the challenges associated with GLP-1 discontinuation populations. According to him, several studies have shown that after 6 or 12 months – and even further out – there are high discontinuation rates for GLP-1s, above and beyond what’s typical for a normal cardiometabolic indication. The reasons, he explained, are multifactorial and include tolerability and efficacy trade-offs.

The issue of cost and access is another important one concerning GLP-1s, he explained. ”We’re increasingly hearing about this from both large pharma and investors and physicians are thinking about this too.”

”As we talk to companies, questions of access, clinical profile, and market landscape are all top of mind – especially as many of these medications will go off-patent over the next 5, 10, or 15 years. These issues are critical as companies plan indication selection and combination therapies, he explained.”

Novo Nordisk’s Lotte Bjerre Knudsen, whose story as a scientist is closely linked to the success of GLP-1-based medicines, shared some of her key learnings.

“GLP-1s are a unique biology, acting through a single receptor, but with wide-ranging effects across organs. However, one limitation is their long-term effect on glucose control; while effective initially, the benefit plateaus over time in diabetes”, she explained.

One key learning she shared is that animal models must reflect human disease: ”Using only young or adolescent animals doesn’t model adult-onset diseases well”, Bjerre Knudsen explained.

She went on to describe how, despite a more than 100-year history of diabetes treatment, the number of people adequately treated remains low, and that both diabetes and obesity are underlying drivers for many cardiometabolic diseases, including atherosclerosis, heart failure, liver disease, and kidney disease: ”The unmet need is substantial”, she said and gave away another key learning: ”Use human data, there has never been a better time to leverage biobanks, genetics, and real-world data.”

For many years, Novo was the only company investing in new medicines for obesity and the only one taking GLP-1 into the field. The company’s structure, being owned by the Novo Nordisk Foundation, has given it a secure funding situation, Bjerre Knudsen said. ”This has allowed us to invest ahead of time, especially in obesity”, she explained, and offered final advice for scientists in the field: ”Don’t fall in love with your target too early. Understand the pathway before committing.”

Regina Friche, Senior Vice President and Global Head of Research at CVRM at AstraZeneca, offered an overview of the company’s focus areas and strategy across cardiovascular, renal, and metabolic disease. She pointed out that AstraZeneca’s key focus areas are novel target discovery, building differentiation in weight management, and developing precision therapies for high-risk subgroups with unmet needs.

AstraZeneca has a long history in cardiovascular disease, with its first product launched in the mid-70s. And the company has continued to invest in this area because it remains a leading cause of mortality and morbidity globally, Friche explained.

In recent years, AstraZeneca has also invested heavily in obesity and weight management, recognizing obesity as a disease rooted in adipose tissue dysfunction that drives multiple cardio-renal-metabolic complications. ”Our approach is holistic”, she emphasized.

There’s still a high unmet need in cardiovascular disease despite many innovations, a fact AstraZeneca is looking to change through its novel target therapies: ”We’re focusing on heart failure, especially HFpEF, and subtypes like pulmonary hypertension and cardiomyopathies. We’re developing targeted therapies using modalities like siRNA, particularly targeted siRNA delivery to cardiomyocytes. We’re also advancing programs in dyslipidemia and treatment-resistant hypertension, including Baxdrostat, our aldosterone synthase inhibitor”, she said.

Renal diseases, with more than 850 million patients worldwide, are also one of AstraZeneca’s focus areas. The pharma giant is also building a rich portfolio addressing chronic and acute kidney injury and autoimmune kidney diseases, she said.

Hai Zhang, Senior Director of Business Development at Roche, pointed out that Roche is structured differently from most pharma companies, with both Diagnostics and Pharma divisions. ”The synergy between diagnostics and pharma accelerates growth in areas like oncology, neurology, and CVM”, he explained.

Roche exited the CVM space about 15 years ago after several Phase 3 failures but has recently re-entered. The company has been rebuilding its CVM portfolio since 2022 through collaborations and acquisitions.

Zhang pointed out that CVM is a broad, multifactorial area and that while GLP-1 therapies have been transformative, comorbidities mean one pathway isn’t enough. ”Combination therapies, such as GLP-1s with other mechanisms like FGF21, are becoming essential”, he said, asserting that; ”We believe in the strength of GLP-1s but also in the importance of combining pathways for success in CVM.”